The University of Chicago endowment grew to a market value of $6.51 billion as of June 30, 2012, marking a 6.8 percent return on investments for the fiscal year 2012. The results exceeded the benchmarks used by the University, during a year in which the global markets struggled.

The average compounded investment result for the University over the last three years was a 14.7 percent return; the average over the last five years was a 4.2 percent gain; and the average over the last 10 years was a 9.6 percent gain. All of those compare favorably to the market-based, strategic benchmarks used by the University for these periods.

The strong recovery of the endowment, after the global financial crisis of 2008 and 2009, took place even as the University established a lower risk profile and significantly improved liquidity. The three-year results reflect positive returns from equities, private markets and bonds, together with strong performance by the University's investment managers, according to Vice President and Chief Investment Officer Mark Schmid.

“We are pleased to report a third year of positive investment results, particularly given the difficult global equity markets over the past year,” Schmid said. “We continue to view investments as an important part of a comprehensive approach to the University’s fiscal health. Working closely with the Investment Committee and University leadership, we believe this approach will best support the University’s mission.”

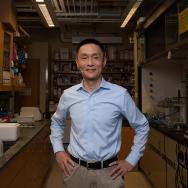

—Prof. Chuan He

—Prof. Chuan He